Handling tax deductible donations at the end of the year can be confusing and daunting. And 2020 threw a few wrenches in the mix. SO–we wanted to create a simple guide, written in layman’s terms, to help you with this year-end task.

HERE IS YOUR 2020 GUIDE TO YEAR-END TAX DEDUCTIBLE DONATIONS

Let’s start with the basics:

WHAT IS A TAX DEDUCTIBLE DONATION?

A tax deductible donation is a contribution of money or goods to a tax-exempt organization such as a charity.

WHAT IS ADJUSTED GROSS INCOME (AGI)?

Adjusted Gross Income (AGI) is defined as gross income minus adjustments to income. Gross income includes your wages, dividends, capital gains, business income, retirement distributions as well as other income. Adjustments to Income include such items as Educator expenses, Student loan interest, Alimony payments or contributions to a retirement account. Your AGI will never be more than your Gross Total Income on you return and in some cases may be lower.

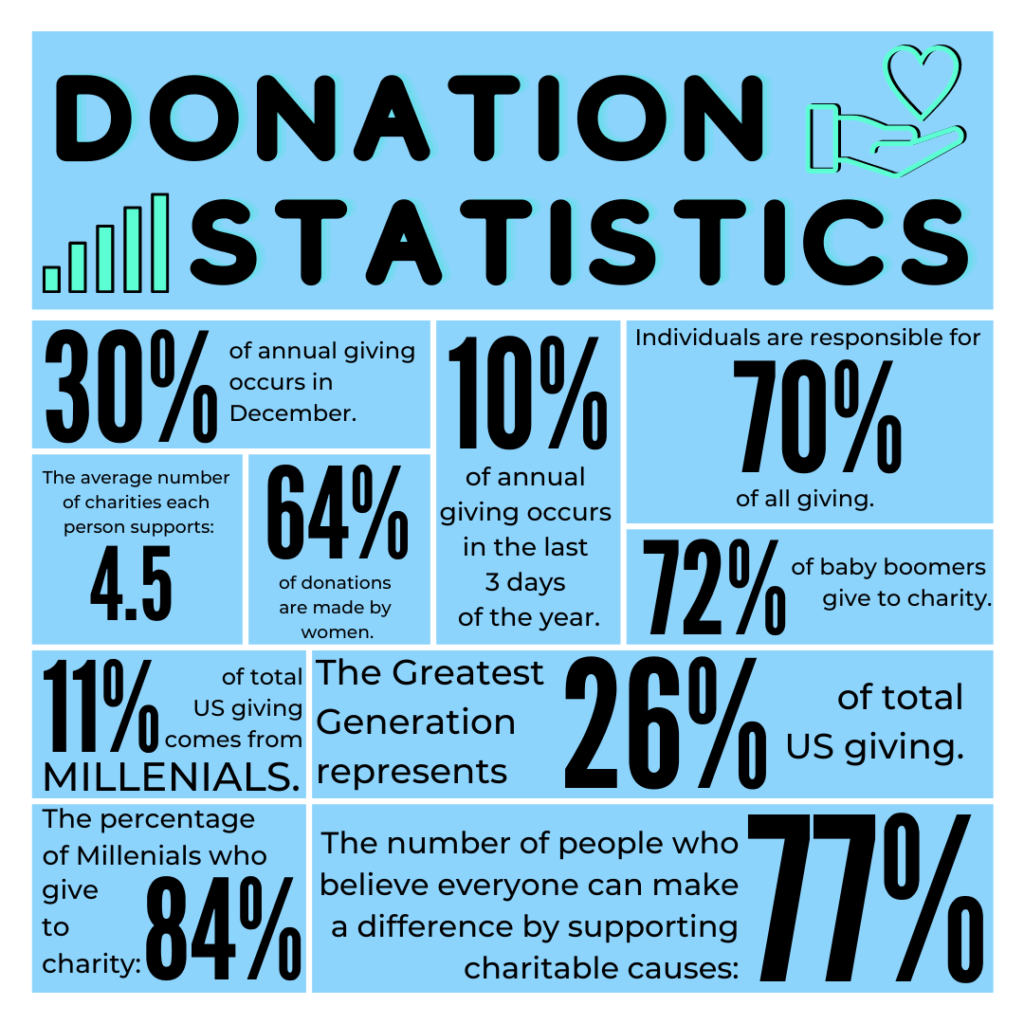

Some fun facts about charitable giving in the United States:

And now, the questions that we all want answered:

HOW MUCH DO I NEED TO GIVE TO CHARITY TO MAKE A DIFFERENCE ON MY TAXES?

Charitable contributions can only reduce your tax bill if you choose to itemize your taxes. Generally you’d itemize when the combined total of your anticipated deductions—including charitable gifts—add up to more than the standard deduction.

HOW MUCH IS A STANDARD DEDUCTION?

| 2020 STANDARD DEDUCTIONS | 2021 STANDARD DEDUCTIONS | |

| SINGLE | $12,400 | $12,550 |

| MARRIED FILING JOINTLY | $24,800 | $25,100 |

| HEAD OF HOUSEHOLD | $18,650 | $18,800 |

HOW MUCH CAN I DEDUCT?

This is where 2020 really shook up some things. Essentially, you may deduct up to 60% of your adjusted gross income (AGI) via charitable donations, but you may be limited to anywhere from 20%-50% depending on the type of contribution and the type of organization. For example, donations to certain private foundations, veterans organizations, fraternal societies, and cemetery organizations may come with a lower limit. BUT—In 2020, when you make a charitable contribution of cash to a qualifying public charity, under the CARES Act, you can deduct up to 100% of your AGI. Check out IRS Publication 526 & How the CARES Act Changes Deducting Contributions to learn more.

WHAT IS THE CARES ACT?

2020 brought about the Coronavirus Aid, Relief, and Economic Security Act (CARES Act), a $2 trillion economic stimulus package legislated to provide immediate relief for nonprofits. The CARES Act was signed into law on Friday, March 27. The bill makes a new deduction available for up to $300 per taxpayer ($600 for a married couple) in annual charitable contributions. In other words, you can deduct up to $300 of cash donations without having to itemize. This is called an “above the line” donation that will reduce your AGI, and thereby reduce taxable income. However, if you make an itemized cash contribution to a qualifying charity, you can deduct up to 100% of your AGI.

HOW DO I KNOW WHAT CHARITIES ARE QUALIFIED?

Not all organizations are tax-exempt. An organization can be a nonprofit without 501(c)(3) status. Verify an organization’s status using the IRS Exempt Organizations Select Check Tool.

WHAT IF I DONATE TO MULTIPLE CHARITIES?

No problem! The deduction limit applies to ALL donations you make throughout the year, no matter how many organizations you donate to.

WHAT IF I EXCEED THE LIMIT THAT CAN BE DEDUCTED?

That’s okay! Many times, the limit can be deducted on your tax returns over the next five years, or until they’re gone, through a process called a tax carryforward.

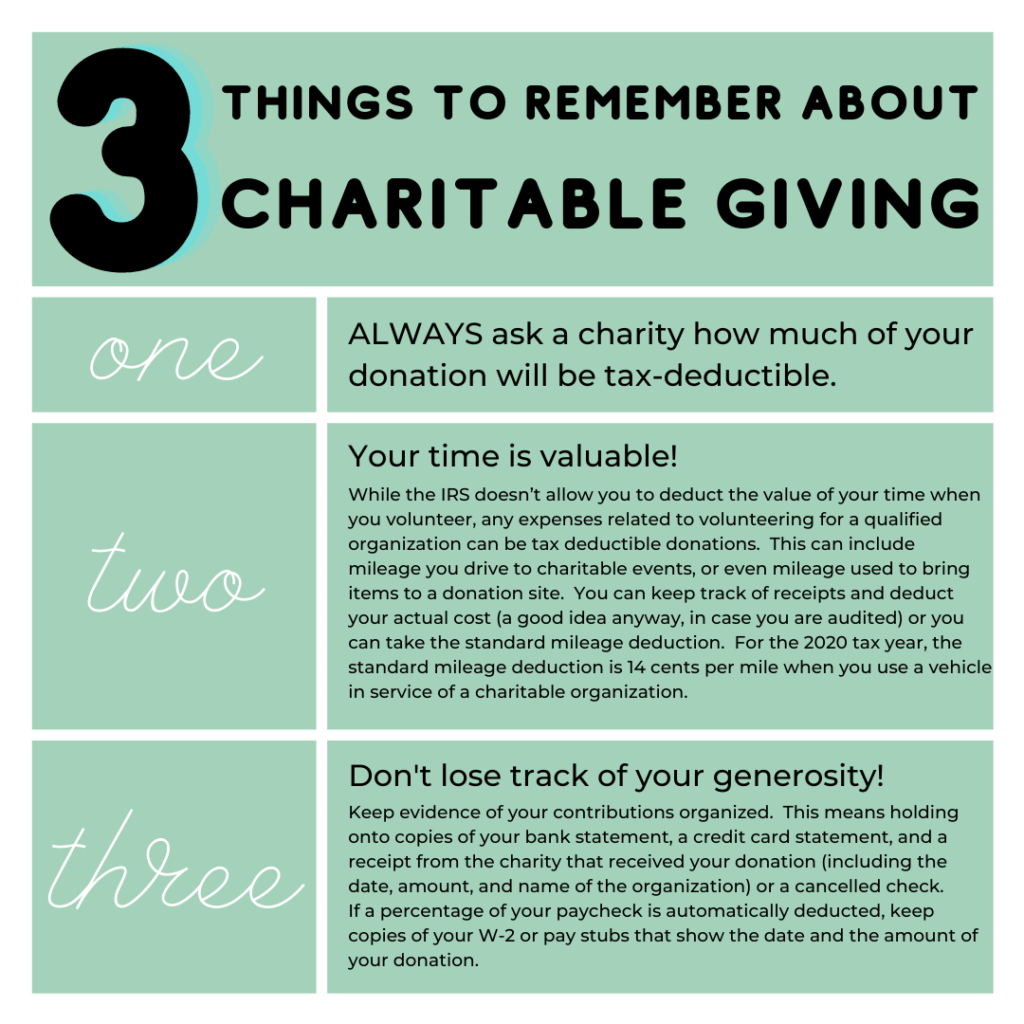

And last, but not least:

HOW DO I CLAIM TAX-DEDUCTIBLE DONATIONS ON MY TAX RETURN?

It’s important to fill out Schedule A in addition to the rest of your tax return. This means that you will need to itemize your deductions in order to claim tax deductible donations to charity. The 2020 tax year is a little different, with the introduction of the CARES Act, which individuals to be able to deduct up to $300 of cash donations without having to itemize. Quite often, itemizing can take more time, be more difficult, or create a higher bill from your tax preparer than simply taking the standard deduction (remember those?). Itemizing only pays off if the sum of your itemized deductions is greater than the standard deduction.

References:

The Balance:

Charity Navigator:

https://www.charitynavigator.org/index.cfm?bay=content.view&cpid=42

Fidelity Charitable:

https://www.fidelitycharitable.org/guidance/charitable-tax-strategies/charitable-tax-deductions.html

Investopedia:

https://www.investopedia.com/financial-edge/0411/donations-how-to-maximize-your-deduction.aspx

IRS:

https://www.irs.gov/e-file-providers/definition-of-adjusted-gross-income

https://www.irs.gov/newsroom/how-the-cares-act-changes-deducting-charitable-contributions

NerdWallet:

https://www.nerdwallet.com/article/taxes/itemized-deductions-standard-deduction

https://www.nerdwallet.com/article/taxes/form-1040

https://www.nerdwallet.com/article/taxes/tax-deductible-donations-charity

Nonprofits Source:

U.S. Charitable Gift Trust:

Make A Wish: